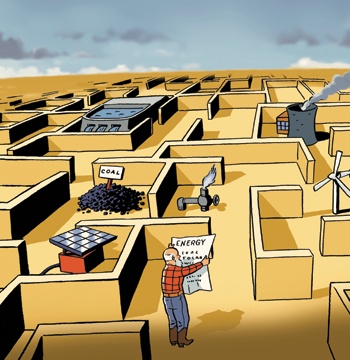

The escalating cost of electricity and predictions of shortages and blackouts, the future of renewable energy, climate change, pollution reduction … these subjects are on consumers’ minds more than ever before. We at Texas Co-op Power have been doing our homework on these issues by attending industry conferences and studying the latest reports to give you an overall view—a reality check, if you will—of Texas electric cooperatives’ energy future.

Our story begins with the fundamental ingredient for producing electricity: fuel. That fuel can come from many sources, as we will explore later. There are many types of electricity generation, but basically a fuel source, such as natural gas or coal, is burned to create steam that turns turbines for electric generators. Texas cooperatives make individual arrangements to acquire electricity either from cooperative generation and transmission facilities, called G&Ts, or other power providers. G&Ts, such as Golden Spread Electric in West Texas and the Panhandle, Brazos Electric Power in Central Texas, and South Texas Electric, are owned by the cooperatives they serve. Cooperatives may also contract with other sources for energy, including the Lower Colorado River Authority and investor-owned utilities.

Co-ops typically supply base-load needs (that portion of the electrical demand that is present at all times) from units burning natural gas or coal. Intermediate and peaking loads, needed to satisfy high demand, are generally served using natural gas-fired power plants. Renewable energies such as water (hydropower), wind and biomass can supplement power supplies, reduce our dependence on fossil fuels and reduce power plant emissions. Co-ops strive to use the most efficient, lowest-cost generating resources first. Other resources are blended during higher load periods, with the objective of minimizing both cost and emissions. Your co-op’s future energy needs must be planned and contracted for years in advance.

Historically, natural gas was relatively inexpensive, so long-term gas contracts were thought to assure low electricity costs for a long time to come. But the market changed. Gas prices went up. Today’s electricity bills reflect the higher fuel costs.

Along with costlier fuel comes a big growth spurt in Texas and an increased demand for electricity. The state has a goal of keeping a reserve power production capability of 12.5 percent. But industry experts say reserve capacity is rapidly diminishing. In fact, officials with the Electric Reliability Council of Texas (ERCOT) grid, which handles 85 percent of the state’s electricity load, predict that the generation reserve margin (available electricity during peak demand times) will fall below 6 percent by 2012. The long lead times needed to obtain environmental permits and to construct new generating plants have caused some to predict future electricity shortages.

And this is happening in the midst of a serious national debate about climate change and a focus on renewable energy sources. Wind power is being hailed as a cheap, renewable source of electricity, especially in Texas, with wind farms cropping up all over the western part of the state. But wind doesn’t blow on demand. And electricity cannot be stored. When you flip the light switch, you’re getting “fresh” power.

Our reality check tells us that wind and other renewables are only part of the solution for the future. No one source can supply our growing electricity needs. Nor can conservation alone suffice. Instead of a silver bullet, there are a multitude of silver pellets. We must look to a variety of energy sources and make a major commitment to researching and developing improved technologies, efficiencies and conservation.

Next month we will concentrate on renewable energies and their great promise for the future. This month we will discuss Texas’ dominant, conventional fuels. So here goes. …

Natural gas

This fuel once was cheap and abundant. But wells started drying up, and prices started heading up. It burns clean, but is there enough to go around?

Within ERCOT, natural gas generated almost half of the electricity consumed last year.

It’s cleaner burning than other carbon-based fuels, such as coal. For example, according to the U.S. Environmental Protection Agency, on average in the United States, coal emits 2,249 pounds of carbon dioxide for every 1,000 kilowatt-hours (kWh) of generation, whereas natural gas emits 1,135 pounds for every 1,000 kWh.

Texas co-ops located outside of ERCOT also rely heavily on power generated by natural gas. These include co-ops within the Southwest Power Pool (SPP), the Southeastern Electric Reliability Council (SERC) and the Western Electricity Coordinating Council (WECC).

The fact that the cost of natural gas has tripled since 2002, taking electricity prices up accordingly, has cooperatives rethinking what fuels to use in the future. Although the cost of natural gas has moderated, it is no longer a low-cost fuel source, and prices can be volatile.

Texas’ current supply of natural gas is adequate for the near future, but the easiest gas to get has been got, so to speak. Extraction from remaining domestic gas fields, such as the Barnett Shale in North Texas, requires expensive new drilling techniques. The Independence Hub, a major new underwater gas field in the Gulf of Mexico some 120 miles from Biloxi, Mississippi, has begun producing. It is expected to increase the nation’s natural gas production by 2 percent by the end of the year. But, again, this high-tech extraction process—from a platform with living quarters for 16 probing for gas 8,000 feet deep—is costly.

It’s possible to import gas, but it must first be turned into a liquid. An overseas facility creates liquefied natural gas (LNG), then ships it in specially built vessels to the U.S. Here, the LNG goes to a docking and conversion station where it’s re-gasified and injected into pipelines for distribution. While some stations already exist in the U.S., a fair amount of the ultimate supply of gas will depend on stations that are still being planned or built.

Pros: Burns clean, can be carried by pipeline.

Cons: The easy-to-tap reserves are tapped out, and supplies are expensive; U.S. reliance on imports is growing.

Outlook: Construction of liquid petroleum gas sea terminals and on-shore re-gasification plants will make imports available. Explorers are looking for new pockets of gas and ways to extract it.

Coal

Our most plentiful fuel attracts attention, but not in a positive way. Environmental advocates don’t like its emissions, but by necessity, it will likely remain a generation mainstay. Will technology provide the answer?

Power plants emit 39 percent of all U.S. carbon dioxide emissions, according to the Natural Resources Defense Council. When Texas Utilities (TXU) announced plans this year to build 11 new coal plants in Texas, it ignited a firestorm of opposition from people who said the emissions would make air quality worse in many small towns and force some cities to further curtail vehicle emissions to offset those from the coal plants. TXU subsequently agreed to drop or postpone eight of the plants and arranged to sell its holdings to a private partnership, which pledges to be a better environmental steward.

Sid Long, executive vice president and CEO at Concho Valley Electric Cooperative, sums up the coal challenge this way: “Obviously, the environmental issue must be resolved in order to use our most abundant resource for electrical generation. Without coal generation, we can expect to pay much more for our electric energy in the near future.”

Coal is the most abundant fossil fuel in the United States, with some estimates projecting a 250-year supply available if consumed at the current rate. Texas has an estimated 200-plus years of lignite, a brownish substance that is lower quality than higher-burning bituminous coal. Lignite occurs in deposits in East and Central Texas and along the Texas Coastal Plain. Some G&T cooperatives already use lignite, which has the advantage of proximity. Higher quality coals must be imported by rail, adding significant costs and risk of supply disruption. The cost of using coal goes even higher if the negative effect on the environment is computed. Although nitrous oxides and sulphur oxides are relatively easy to scrub from coal plant emissions, carbon dioxide and mercury are not. Newer coal plants will have improved emission-control technology, such as a proposed plant in Kansas, part of which will be dedicated to serving loads in Texas.

“This new coal-fired plant will operate 10 percent more efficiently than the coal plants that were formerly providing this power,” said Bob Bryant, president and general manager of Golden Spread Electric Co-op. His G&T is partnering with three other co-ops in the project. But even as new plants are designed for cleaner emissions, some in the government are supporting taxes on coal itself or carbon dioxide emissions.

Most technologies for reducing carbon dioxide from coal plants are costly. In fact, most are experimental. For example, coal gasification, which turns coal or lignite into a gas used to power jet turbines, increases the cost of producing electricity by about 50 percent. Only recently, the Texas-based Tondu Corp. canceled plans to build a coal gasification plant in Corpus Christi because the technology turned out to be too expensive.

Still, there are innovations on the horizon. The most advanced research in clean coal technology may be coming to Texas. FutureGen Industrial Alliance Inc., a nonprofit industrial consortium, is planning on building the world’s first integrated gasification combined-cycle coal-fired plant with near zero emissions. Two of the four finalist sites for the plant, scheduled to open in 2012, are in Texas: Penwell, near Odessa, and Jewett, east of Waco.

An April 2007 New York Times poll indicated that 69 percent of Americans polled would approve building advanced coal plants that produce less air pollution even if they had to pay more for their electricity.

Pros: Texas has lots; it’s easy to dig up and doesn’t require expensive rail transportation.

Cons: Requires heavy emissions cleanup. Carbon dioxide and mercury emission reduction processes are still being developed.

Outlook: Long-term supply available. Technology improvements expected.

Nuclear

A renaissance of interest in this energy source has been sparked by the fact that it produces no greenhouse gases. Technological advances have made plants safer, but what to do with that waste?

Texas G&Ts do not produce nuclear power, but they could invest in nuclear power in the future. Government statistics for 2005 show that nuclear energy accounted for 11 percent of Texas’ electricity, compared to about 19 percent nationwide and 16 percent worldwide. After a three-decade-long hiatus in U.S. construction, nuclear plants are again being planned. The plants are very expensive to build—as much as $2,000 or more per kilowatt—and require an average of seven to nine years for construction, following a lengthy permitting process. (It would cost less than a third of that per kilowatt and take just two years for construction of a natural gas turbine.)

Once a nuclear plant is in operation, its variable cost of energy production is about the same as a coal plant. Nuclear power could supply about half the state’s expected growth in electricity and displace about 80 million tons of carbon dioxide emitted by coal-burning plants. But while nuclear plants do not emit carbon, their radioactive waste will have to be stored and monitored longer than any civilization has ever existed. Plutonium, a radioactive by-product of power reactors, has a half-life of 24,000 years. The planned Yucca Mountain Repository in Nevada, a project of the U.S. Department of Energy, is slated to begin accepting the nation’s nuclear waste in 2017. However, many question mankind’s ability to safeguard such a concentration of nuclear waste for the thousands of years it would remain hazardous.

A New York Times poll June 1 showed 51 percent of Americans sampled approved building more nuclear power plants, but 55 percent disapproved of having nuclear power plants built in their communities.

Pros: Power with no air pollution, at approximately the same cost as coal.

Cons: Plants are expensive to build and retire. Radioactive waste is with us for thousands of years.

Outlook: New technologies are making plants safer and more efficient, but permitting and construction take years.

Energy management and efficiency

Cutting electricity usage and waste could stretch our supply. But will enough people embrace this less-is-more philosophy?

When all is said and done, progress in the electric power industry for the near future may be measured not in kWh sold but in kWh saved. Certainly that is the case in Texas. As pointed out by Ray Beavers, CEO of United Cooperative Services and vice chair of Texas Electric Cooperatives (TEC), the co-ops’ statewide association, “There just isn’t enough time to site, plan and construct new power plants by the time ERCOT predicts Texans may experience electricity shortfalls starting in 2009–2010.” However, according to Beavers’ calculations, “If Texas consumers reduced their peak energy use by 10 percent, they would save 7,000 megawatts of generating capacity, or almost the same generating capacity TXU’s 11 plants would have provided—without pollution, transmission and utility debt.”

Electricity shortages could well produce rolling blackouts when the temperature reaches 100-plus and the whole household is busy making the electric meter spin, for example, or when a key plant has to go off line for maintenance during a period of high demand. A cooperative’s base-load electricity resources will be producing at their maximum. Those peak-energy consumption times are handled by “peaking” units. Beavers thinks one key strategy for getting through the coming crunch is for co-op members to dedicate themselves as never before to energy efficiency.

If “peak” demand can be reduced, the demand for new electricity generating plants can also be reduced, thus buying time for improved technology to come on line.

Conservation and technology go hand in hand. Electric cooperatives across the country are investing millions in new technologies. But research needs to be done on such a massive scale that it can only be accomplished through a national commitment. “The federal government should go into hyperdrive to fund energy research,” said Greg Jones, chair of the TEC board and general manager of Cherokee County Electric Cooperative. “If the government will work in partnership with the electric industry rather than mandating what may turn out to be impossible goals, we will arrive more quickly at our mutual goal of making electricity generation cleaner and more efficient.”

The old energy philosophy, “Use as much as you want. We’ll make more,” is no longer applicable.

Co-ops and cooperative members are an integral part of the debate over how much money and effort we are willing to spend to keep up with demands for more and cleaner power. Co-op by co-op, we will have the opportunity to consider what technologies are best for the future.

COMING NEXT MONTH: Part Two of Energy Reality Check, covering renewable energy: wind, solar, hydro and biofuels.

——————–

Kaye Northcott is retired editor of Texas Co-op Power. Roxane Richter is a Houston-based business writer.