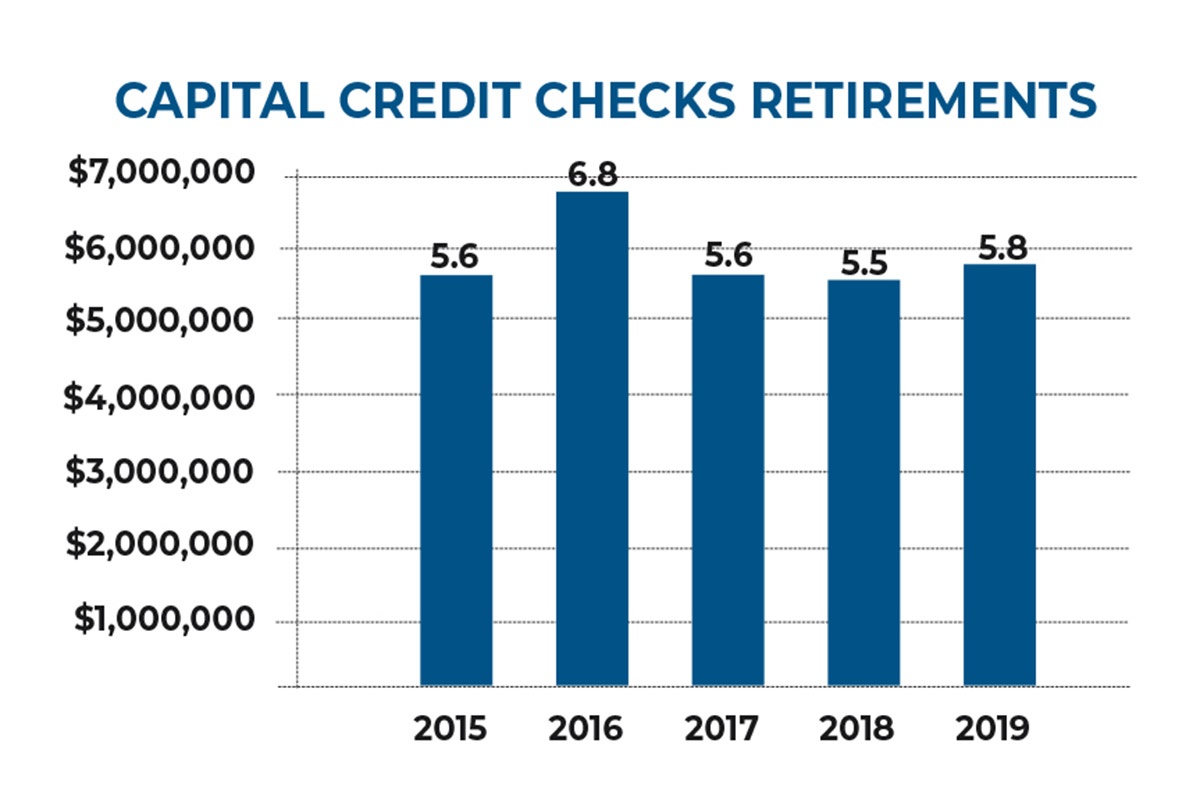

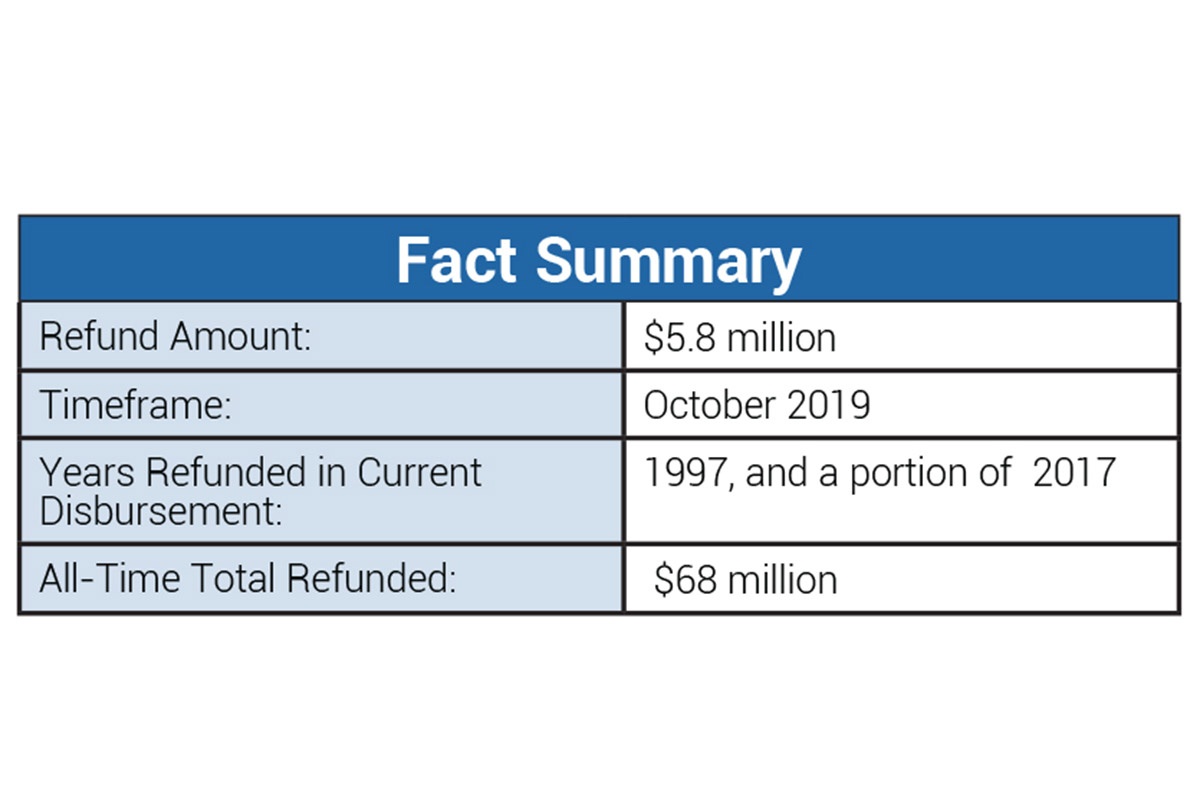

The retirement of capital credits is the tangible demonstration of your ownership in Magic Valley Electric Cooperative. As a member-owned cooperative, MVEC operates as a not-for-profit utility. This is accomplished through the retirement of capital credits. This year your board of directors has approved to retire capital credits to those consumer-members who received electric service in 1997 and a portion of capital credits in 2017. In fact, we will mail capital credit checks to more than 65,800 qualifying members, totaling approximately $5.8 million, in October of 2019.

What Are Capital Credits?

Any profits made by the cooperative are referred to as margins. At the end of each year, the margins (profits) are allocated to each member in proportion to the amount of electricity they purchased. The more electricity purchased, the greater the share of the margin allocation that will be made to the member’s capital credit account. We have been retiring capital credits since 1950 and have returned more than $68,000,000 in capital credits to our members. When the allocated funds are returned as capital credits to the cooperative’s members, we say that those capital credits have been retired.

What Is the Method of Calculating Capital Credits?

The retirement is based on a percentage of the member’s total accumulated capital credit balance. The amount retired this year is subtracted from the total amount that was allocated in previous years, with the earliest year being retired first. The retirement will be made from the funds that have been held by the cooperative for the longest period.

Before distributing the capital credits, your board of directors at MVEC must first consider the financial condition of the cooperative and the needs for capital funds for the coming years. The percentage figure used to calculate the annual retirement of capital credits, determined by your board of directors, is set at a level that maintains the financial integrity of the cooperative.

Members with 1997 allocation on record will receive a 100 percent distribution of their remaining capital credits for that year. The total distribution is $5,383,630.

Members with 2017 allocations on record will receive a partial distribution this year, totaling $5,000,000. Approximately $5,100,000 that will remain on record for 2017 will be distributed in future year(s).

Capital Credits Questions & Answers

We have provided answers to some questions for a better understanding of capital credits.

What’s the difference between allocated and retired capital credits?

Allocated capital credits appear as entry on the permanent financial records of the co-op and reflect your equity or ownership in MVEC. When capital credits are retired, a check is issued to you and your equity in the co-op is reduced.

How often will I receive an allocation notice?

You will receive an allocation notice annually after the finances for the previous year books have been completed.

How are capital credits calculated?

The amount of capital credits you earn in a given year is based upon the amount of capital you contribute to the co-op through payment of your monthly bills.

The more electric service you buy, the greater your capital credit account – although the percentage will remain the same. The sum of your monthly bills for a year is multiplied by a percentage to determine your capital credits.

What do I have to do to start accumulating capital credits?

Capital credits are calculated by MVEC for every member that purchased electricity during a year in which the utility earned margins. No special action is required to start a capital credit account. Your membership activates your capital credit account.

What percent of my bill is returned as capital credits?

The percentage of your total payment that is allocated as capital credits varies from year to year, depending on the success of the co-op.

Capital credits are only allocated for a year in which MVEC earns margins. Since capital credits are a member’s share of the margins, no credits are allocated for a year with no margins.

Do I have to be a member for an entire year to earn capital credits?

No. Capital credits are calculated based upon a member’s monthly bills. If you are billed for service for even one month, you will accumulate some capital credits if MVEC earned margins in that year.

What happens to the capital credits of a deceased member?

The capital credit checks are issued in the name of the deceased estate or beneficiary once that person has been identified.

Will I receive a capital credit check every year?

Not necessarily. The board of directors must authorize a retirement before you receive a check. When considering a retirement, the board analyzes the financial health of the cooperative and will not authorize a retirement if Magic Valley cannot afford it.

What happens to my capital credits when I leave the MVEC service area?

They remain on the books in your name until they are retired. You should ensure that MVEC has your current mailing address.

You can find more information about capital credits online at magicvalley.coop, or you can call us at 866-225-5683 and speak directly with a customer service representative.